Within the last twenty years, shopping for a new mattress has changed immensely. Where brick-and-mortar used to be the only way to buy a new mattress, online storefronts now provide a suitable option.

Mattress companies selling directly to consumers help to keep prices low and provide consumers with unparalleled convenience and options. Order with a few clicks, fast and free shipping, and send it back for free if you don’t like it.

How do online mattress sales compare with the traditional in-store mattress buying experience?

In this mattress industry stats roundup, we’re answering the following questions:

- How much money is in the mattress market?

- What is the average price of a new mattress?

- Where are most mattresses purchased?

- Who is most likely to buy a mattress online?

- What public mattress companies have the most sales?

- What mattress companies are worth the most?

- What online companies have the highest customer satisfaction?

- What is the average trial period of a new mattress?

- What is the average warranty length of a new mattress?

- What is the cost to advertise?

- What is the average annual expenditure of mattresses?

So, without further ado, here’s a summary of the most interesting stats in the mattress industry. Let’s get started.

Mattress Industry Statistics (Editor’s Picks)

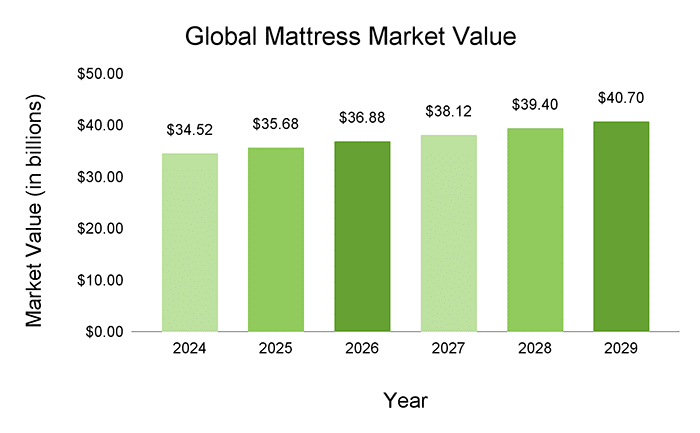

- Worldwide mattress market value: There is currently $34.52 billion in the mattress market worldwide (2024).

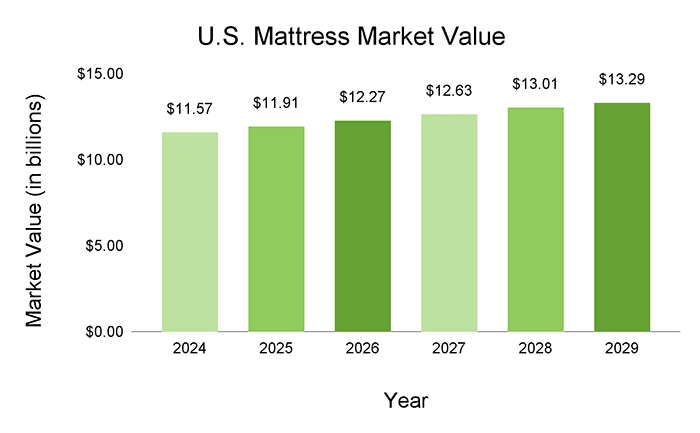

- US mattress market value: The US mattress market has a projected value of $11.57 billion for 2024.

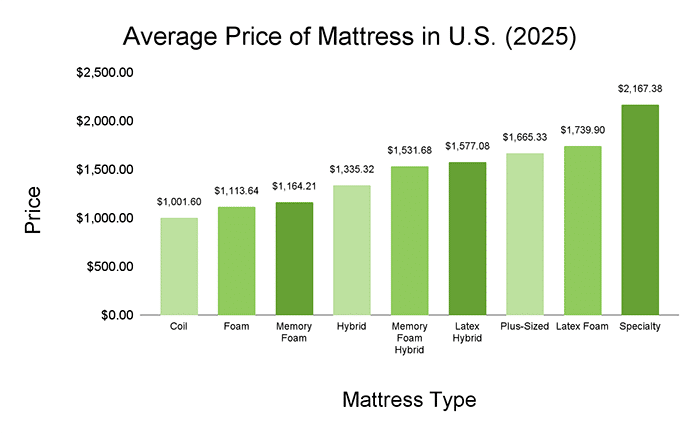

- Average mattress price: Coil-based mattresses cost $1,000 with foam and memory foam mattresses costing $1,150 on average. Hybrids average $1,300, but memory foam and latex hybrids average $1,500. Topping out the list are plus-size and latex foam mattresses costing $1,700. The most expensive type are specialty mattresses which average $2,100.

- Most economical mattress: Coil-based mattresses are the most economical type you can buy today ($1,001)

- Who shops online: Recent surveys say 47% of consumers have considered buying a mattress online. Sleepers between the ages of 18-35 are most likely to shop for a mattress online (71%).

- Most online mattress sales: Tempur Sealy brings in the most revenue of any public mattress company with $4.89 billion in revenue (2024), followed by Sleep Number at $1.73 billion, and then Purple at $0.50 billion.

- Average trial period: The vast majority of mattresses have at least a 100-night trial period (94.1%) and 27.1% of mattresses offer a full-year trial.

- Average warranty period: 51.9% of mattresses we’ve tested come with a 10-year warranty. For the longest warranty length, 25.6% of mattresses we’ve tested come with lifetime warranties.

- Most costly keywords on Google Ads: “Casper” is the most expensive at $23.10 per click, followed by “Organic Mattress” at $20.64, and then “Brentwood Home” at $20.60.

How much money is in the mattress market?

Worldwide: There is $34.52 billion dollars (2024) in the mattress market worldwide, with an annual growth rate of 3.35% CAGR. By 2029 there will be an estimated $40.7 billion in the mattress market globally.

US only: Looking specifically at the US mattress market, it had a valuation of $11.57 billion in 2024 with an annual growth rate of 2.98% CAGR. By 2029 there will be an estimated $13.39 billion in the mattress market in the US.

Sources: Statista 1, Statista 2

What is the average price of a new mattress in the US?

The average price of a new mattress depends largely on the type of mattress.

Coil-based mattresses are the most economical ($1,001), which is closely followed by foam and memory foam mattresses ($1,113 and $1,164 respectively). We see an increase in price with hybrids of all types ranging from $1,300 – $1,600.

From there plus-sized and latex foam mattresses fall within the $1,500 – $1,800 range, with specialty mattresses being the most expensive on average at $2,167.

Sources: Naplab

How many mattresses are sold online?

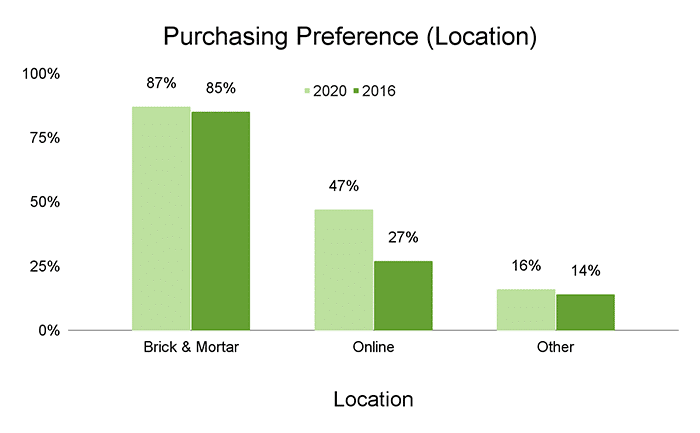

Over the years mattress shopping is starting to trend to more online shopping, but still has a solid foundation in brick-and-mortar stores.

In 2020, 87% of participants in the survey by the Better Sleep Council stated they would purchase a new mattress in brick-and-mortar stores, which is only a slight 2.0% increase from the same survey in 2016.

However, online shopping shows a different story. In 2016 only 27% of participants stated they would purchase a new mattress online which is 20% less than in 2020.

Sources: BedTimesMagazine

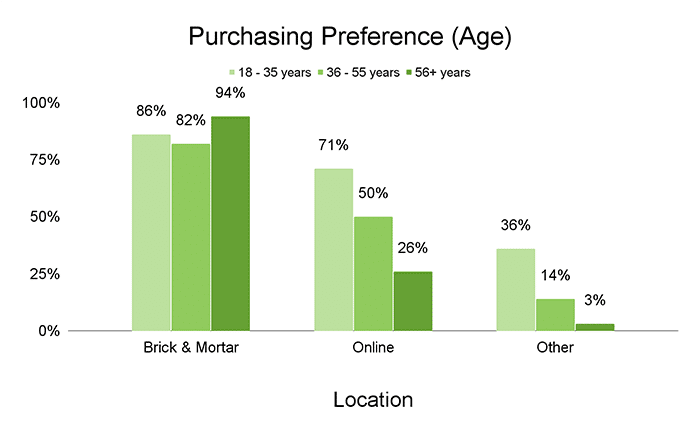

Who is most likely to purchase a mattress online?

Since 2016, consumer preference for purchasing online has increased from 27% up to 47%.

Spread out among age groups, consumers aged 18-35 are most likely to shop online (71%) and ages 36-55 are second most likely (50%). Unsurprisingly, sleepers 56 and older are least likely to purchase a mattress online (26%).

Sources: BedTimesMagazine

What public mattress companies have the most sales?

Tempur Sealy brings in the most sales (revenue) of any publicly traded mattress company, topping the charts at $4.89 billion in sales in 2024.

Tempur Sealy is followed by Sleep Number ($1.73 billion), and then Purple ($0.50 billion).

Source: Companies Market Cap

What mattress companies are worth the most?

While private companies don’t often publish detailed financials, we do have the numbers from a few noteworthy public companies.

Here we’re going to talk through the profits and trajectories of three big players in the mattress market—Tempur Sealy, Sleep Number, and Purple.

In this comparison, we’re primarily looking at the market cap, although other factors certainly come into play, including total revenue earned as well as net sales.

What is the market cap?

Market cap stands for market capitalization. This metric measures what a company is worth on the open market, as well as the market’s perception of its future. A company’s market cap reflects what investors are willing to pay for it.

| Rank | Company | Market Cap |

|---|---|---|

| 1 | Tempur Sealy | $9.63 billion |

| 2 | Sleep Number | $0.45 billion |

| 3 | Purple | $0.11 billion |

Source: Companies Market Cap

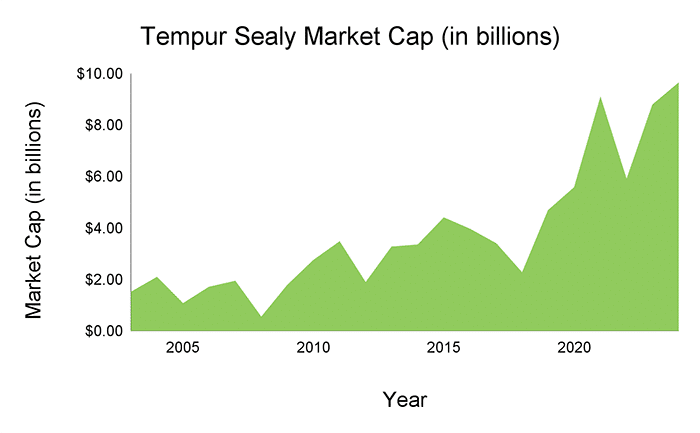

1. Tempur Sealy

Temur Sealy has the highest market cap of any online public mattress brand we looked at—a total of $9.63 billion. Public records for this company date back to 2003.

In 2017, the company made a shift towards more online sales after facing a loss of nearly $600 million in bedding shipments.

With this adjustment, Tempur Sealy was able to ride the wave of the pandemic with extraordinary growth as more shoppers switched to online shopping and supported the company.

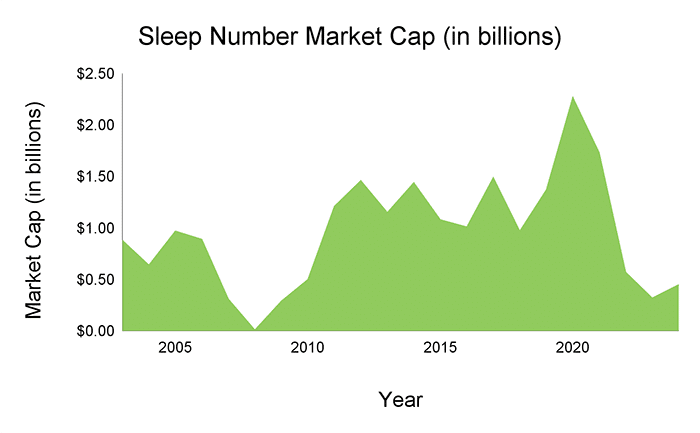

2. Sleep Number

Sleep Number tops the chart as runner-up at $0.45 billion. This company offers both online and in-store purchasing options and has experienced growth for the past 20 years (albeit rocky in some economies).

Similar to Tempur Sealy, we see a huge influx of value following the 2020 pandemic as more shoppers bought mattresses online and Sleep Number was well equipped to handle the influx of orders.

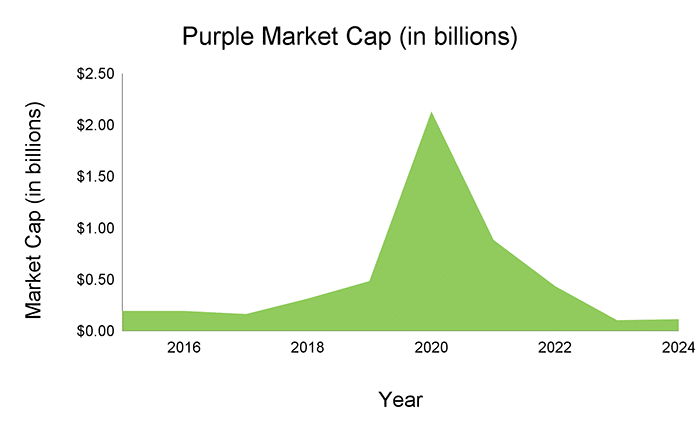

3. Purple

Purple Mattress was launched in January 2016, the newest company among the three public entities we looked at. Despite its delay in entering the market, Purple was a real game-changer. Purple focused huge amounts of effort (and money) on digital marketing ads.

That being said, Purple could have a bit of a rocky road ahead. The chart above shows the height of the market cap peaking around Q1 2021 and having a steady decline since.

Sources: Companies Market Cap

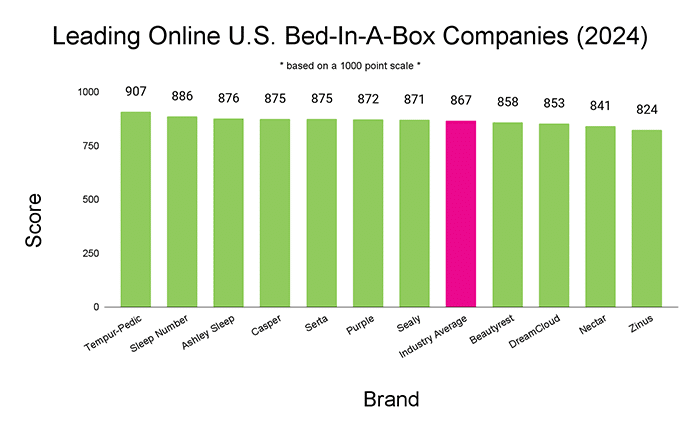

What online mattress companies have the highest customer satisfaction?

The following 7 mattress companies have higher customer satisfaction than the average score across the industry.

- Tempurpedic

- Sleep Number

- Ashley Sleep

- Casper

- Serta

- Purple

- Sealy

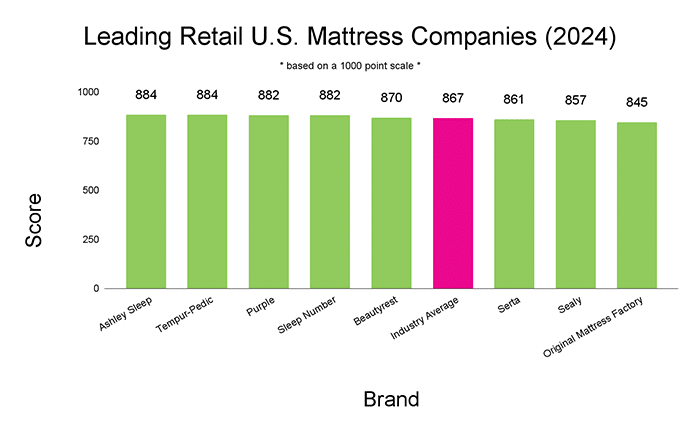

These 5 retail mattress brands have a higher customer satisfaction than the industry average.

- Ashley Sleep

- Tempurpedic

- Purple

- Sleep Number

- Beautyrest

Sources: J.D. Power

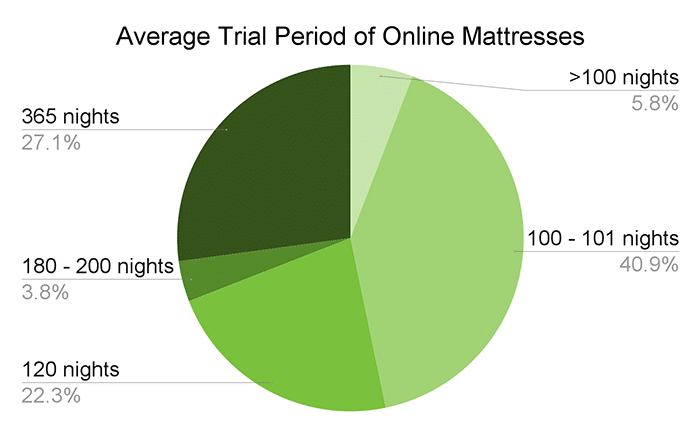

What is the average trial period of online mattresses?

NapLab has tested over 290 of the most popular mattresses so far.

Among those, the majority of mattresses have at least a 100-night trial period, with the average length being 176 nights.

- 17 out of the 290 mattresses had less than a 100-night trial (5.8%)

- 119 out of the 290 mattresses had between a 100 / 101-night trial period (40.9%)

- 65 out of the 290 mattresses had a 120-night trial period (22.3%)

- 11 out of the 290 mattresses had between 180 and 200-night trial periods (3.8%)

- 79 out of the 290 mattresses had a 365-night trial period (27.1%)

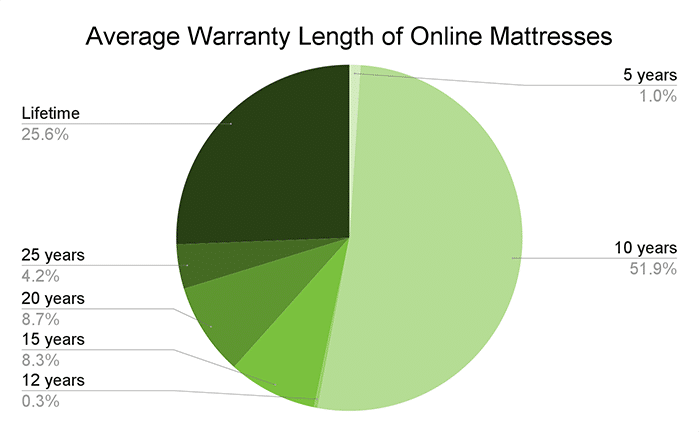

What is the average warranty of online mattresses?

NapLab has tested over 290 mattresses to date. Among those, the average warranty length is 13 years. This doesn’t include the nearly 26% of mattresses that come with a lifetime warranty.

- 3 mattresses we’ve tested come with a warranty of 5 years (1.0%)

- 150 mattresses we’ve tested come with a warranty of 10 years (51.9%)

- 1 mattress we’ve tested comes with a warranty of 12 years (0.3%)

- 24 mattresses we’ve tested come with a warranty of 15 years (8.3%)

- 25 mattresses we’ve tested come with a warranty of 20 years (8.7%)

- 12 mattresses we’ve tested come with a warranty of 25 years (4.2%)

- 74 mattresses we’ve tested come with a lifetime warranty (25.6%)

What is the cost to advertise by brand?

In the online sector, words have value. Brands have value. And talking about certain brands and topics comes at a cost.

To look into this cost, we analyzed cost-per-click data to advertise on Google Ads. We looked at 3 different search term categories.

- Generic terms (ie: best mattress, organic mattress, hybrid mattress)

- Online brands (ie: Leesa, Purple, Ghostbed)

- Legacy brands (ie: Tempurpedic, Sealy, Simmons)

The chart below outlines the cost of 27 of the top-performing brands, in order of cost per click on Google ads, from most expensive to least expensive.

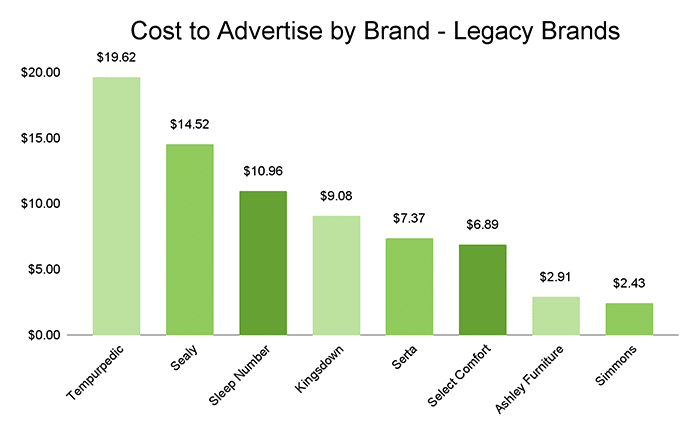

This chart highlights the cost of keywords based on legacy brands. These brands were born from a physical storefront, brick and mortar, and expanded into the online sector at a later date.

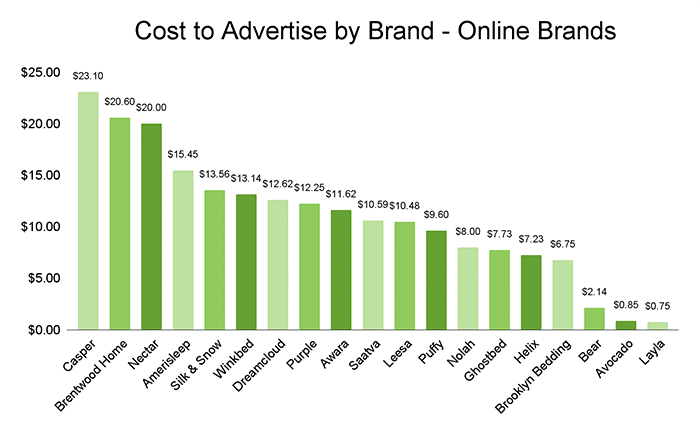

This chart highlights the cost of keywords based on online brands. These brands were born directly into the online marketplace. This can have advantages and disadvantages in terms of cost of advertising.

Comparing Legacy Brands and Online Brands, the average advertising cost for legacy brands is $9.22 and the average advertising cost of online brands is $10.86.

Note: These numbers are based on the top of the page bid for each keyword (high range).

The table below outlines the cost for each search term we researched. These are a mix of brands, mattress terms, and other related keywords.

| Rank | Keyword | Top of page bid (low range) | Top of page bid (high range) |

|---|---|---|---|

| 1 | casper | $5.17 | $23.10 |

| 2 | organic mattress | $4.85 | $20.64 |

| 3 | brentwood home | $1.13 | $20.60 |

| 4 | nectar | $4.42 | $20.00 |

| 5 | tempurpedic | $4.16 | $19.62 |

| 6 | natural mattress | $4.07 | $17.57 |

| 7 | best mattress | $4.20 | $17.14 |

| 8 | amerisleep | $2.67 | $15.45 |

| 9 | sealy | $3.20 | $14.52 |

| 10 | silk & snow | $2.40 | $13.56 |

| 11 | winkbed | $3.12 | $13.14 |

| 12 | mattress | $2.78 | $13.00 |

| 13 | dreamcloud | $3.54 | $12.62 |

| 14 | purple | $1.82 | $12.25 |

| 15 | awara | $3.69 | $11.62 |

| 16 | hybrid mattress | $2.50 | $11.31 |

| 17 | sleep number | $2.83 | $10.96 |

| 18 | saatva | $3.68 | $10.59 |

| 19 | leesa | $1.14 | $10.48 |

| 20 | puffy | $4.00 | $9.60 |

| 21 | memory foam mattress | $2.28 | $9.40 |

| 22 | latex mattress | $2.43 | $9.17 |

| 23 | kingsdown | $1.83 | $9.08 |

| 24 | nolah | $4.00 | $8.00 |

| 25 | ghostbed | $1.71 | $7.73 |

| 26 | coil mattress | $1.91 | $7.55 |

| 27 | serta | $1.79 | $7.37 |

| 28 | helix | $3.00 | $7.23 |

| 29 | select comfort | $2.60 | $6.89 |

| 30 | brooklyn bedding | $4.75 | $6.75 |

| 31 | innerspring mattress | $1.73 | $6.52 |

| 32 | spring mattress | $1.54 | $5.86 |

| 33 | ashley furniture | $0.89 | $2.91 |

| 34 | simmons | $0.54 | $2.43 |

| 35 | bear | $0.31 | $2.14 |

| 36 | avocado | $0.04 | $0.85 |

| 37 | layla | $0.50 | $0.75 |

Source: Google’s Keyword Planner Advertising Tool

As you can see from the table above, Casper, Brentwood Home, and Nectar have the highest cost for brand searches, higher than all legacy brands.

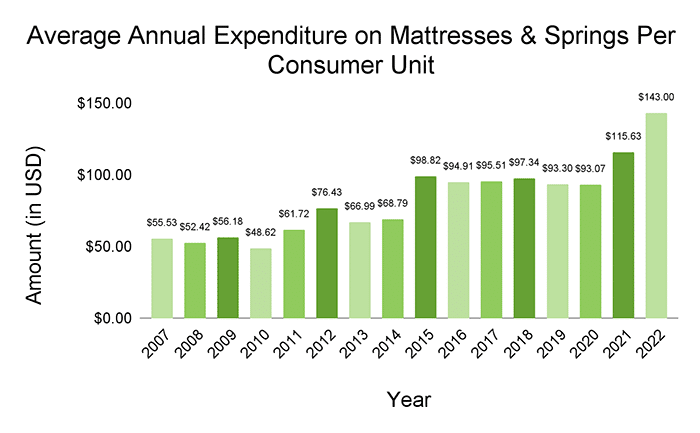

What is the average annual US expenditure on mattresses?

The average annual expenditure can be defined as the average amount consumers spend on a certain product each year. Most consumers do not purchase a new mattress each year.

On average, a mattress will last about 7 years.

Because it is not an annual purchase, the average expenditure is lower than the cost of a new mattress, since the cost is divided by all of the potential consumers in the U.S.

As you can see in the chart above, the amount of money that consumers are spending on mattresses has nearly tripled in the last 15 years, citing a 30% jump between 2014 and 2015 alone.

Sources: Statista 1