Mattress Advertising Statistics (2023)

Written by: Derek Hales

Published on: June 21, 2022

To compete against established legacy mattress brands like Tempurpedic, Sealy, Serta, and Simmons, new mattress companies need a new look.

Brand recognition is critically important for new mattress companies to take business from existing players in the market.

This analysis includes statistics on the following topics.

- Do people recognize online mattress brands?

- Does brand recognition influence mattress purchasing?

- Where do consumers purchase their new mattress?

- How do online mattress brands advertise?

- What is the cost to advertise on Google by brand?

Mattress Advertising & Branding Stats (Editor’s Picks)

- Online Influence: Digital interaction influences 70% of purchases.

- Subconscious Influence: Up to 90% of all purchase decisions are made subconsciously.

- Men vs. Woman: 38% of men recognized one or more direct-to-consumer mattress brands compared to only 29% of women.

- Purple’s Reach: 48% of consumers have heard of Purple mattress. Of that 48%, 83% would consider purchasing a Purple.

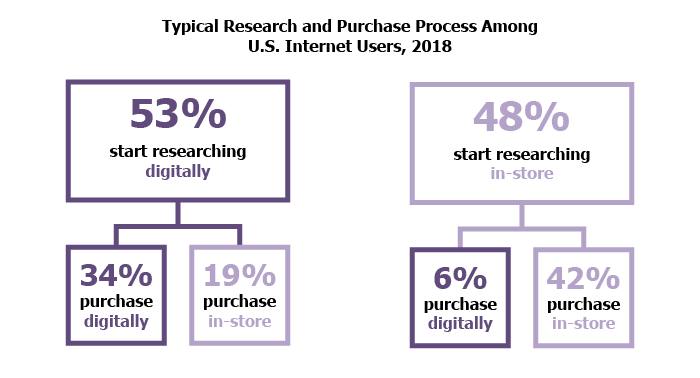

- Online vs. In-Store: 53% of consumers start their mattress research online, 48% reported they began their research in-store.

- Advertising Effectiveness: 57% of consumers report that they have “never seen” a direct-to-consumer mattress advertisement.

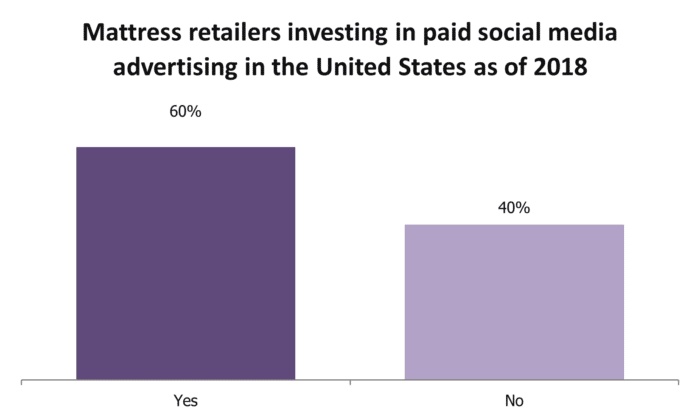

- Social Media: 60% of all mattress companies engage in paid social media marketing campaigns.

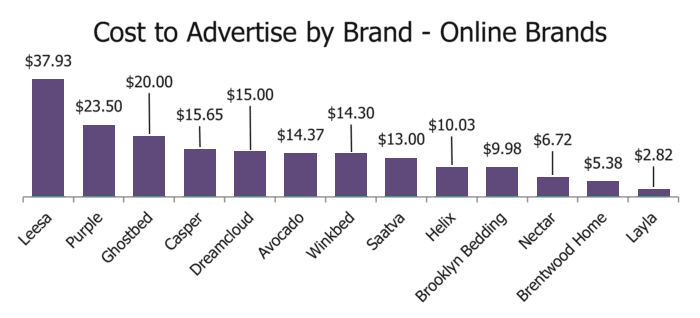

- Online Search Ads: The cost-per-click can be as high as $37 to bid on popular online mattress keywords on Google.

Do people recognize online mattress brands?

Men are 9% more likely than women to recognize a direct-to-consumer mattress brand. A study for 1,053 respondents showed that 38% of men recognized one or more direct-to-consumer mattress brands. The same study revealed that only 29% of women recognized the same brands.

Among recognized brands, Casper was the most recognizable, according to Statista. However, more recent studies have shown that Purple is the most widely recognized online mattress brand.

According to survey results from Latana, Purple was recognized by 48% of people surveyed and 83% of those people have considered purchasing from the brand.

| Brand | Total | Female | Male |

|---|---|---|---|

| None of the above | 67% | 71% | 62% |

| Casper | 17% | 17% | 18% |

| Tuft & Needle | 6% | 7% | 4% |

| Leesa | 6% | 5% | 6% |

| Cocoon by Sealy | 6% | 6% | 6% |

| 4Sleep | 5% | 3% | 6% |

| Helix | 5% | 4% | 7% |

| Bear | 4% | 2% | 5% |

| Sapira | 4% | 3% | 5% |

| Hyphen | 2% | 1% | 2% |

| Eve | 2% | 1% | 3% |

| Bedaga | 1% | 0% | 2% |

Does brand recognition influence mattress purchasing?

Recognizing a brand is the first step, but being able to convert that recognition to actual purchase dollars is another task entirely.

The table below outlines popular direct-to-consumer mattress brands, noting their recognition factor as well as whether or not people who recognize the brand have also considered using the mattress.

| Brand | Have heard of the brand | Have considered using |

|---|---|---|

| Purple | 48% | 83% |

| Casper | 43% | 51% |

| Tuft & Needle | 9% | 51% |

| Leesa | 19% | 57% |

| Nectar | 14% | 51% |

| Saatva | 10% | 51% |

| Ghostbed | 10% | 50% |

Sources: BAER, eMarketer, Latana, Statista

Online vs. In-Store: Where do consumers purchase their new mattress?

When consumers are preparing to make a purchase, 53% of respondents say they begin the research process online, while 48% rely on in-store options for preliminary info.

From those respondent pools, 34% of people who began research online also make the final purchase digitally, while 19% opt for in-store purchasing.

Of the 48% of respondents who researched in-store, only 6% of those purchased digitally, and 42% purchased in-store purchasing.

Sources: eMarketer

How do online mattress brands advertise?

Advertising is an important part of all mattress sales, but even more so for direct-to-consumer brands who often function almost entirely online (with a handful of exceptions).

Knowing where future customers may be coming from gives companies an advantage to prepare targeted marketing strategies that meet those consumers where they are.

The table below shows where consumers have seen mattress advertisements for direct-to-consumer brands.

Where do consumers see online mattress advertisements?

| Where They Saw The Ad | Total | Female | Male |

|---|---|---|---|

| I have never seen one | 57% | 60% | 55% |

| On TV | 26% | 24% | 28% |

| On websites as a banner | 14% | 12% | 16% |

| On social media (ex: Facebook) | 13% | 14% | 13% |

| In magazines | 6% | 5% | 8% |

| On billboards / posters | 5% | 4% | 6% |

From this data, we can gather that digital advertising is king for these online brands and print advertising is secondary.

Less than 10% of direct-to-consumer mattress companies rely on magazine, billboard, or poster advertising.

How many mattress brands advertise on social media?

Among all mattress companies in the U.S. (direct-to-consumer and others), 60% utilized paid social media advertising as a way to increase sales.

Sources: Statista 1, Statista 2

What is the cost for mattress ads on Google?

A brand’s name and recognition power is strongly associated with its online cost to advertise. More valuable brands cost more to advertise with that name.

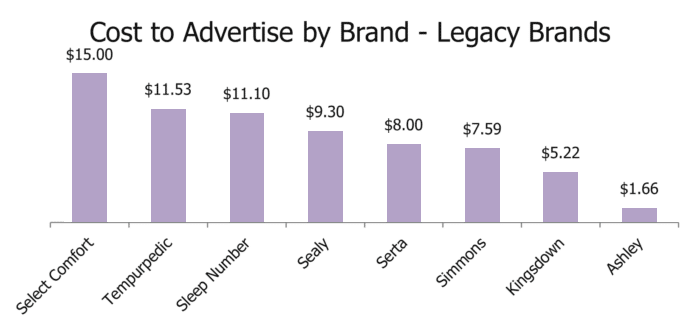

The charts below document the cost to advertise on Google ads by brand for both online brands as well as more traditional legacy brands.

As you can see, Leesa, Purple, and Ghostbed are the top three most valuable brands by keyword alone.

By comparison, Select Comfort, Tempurpedic, and Sleep Number are the top three legacy brands. But even being at the top of the list, these three brands still fall below the value of the top three online brands based on cost-per-click keyword data.

The table below shows our full analysis, looking at legacy brands, direct-to-consumer brands, and other popular mattress search terms.

| Rank | Keyword | Top of page bid (low range) | Top of page bid (high range) |

|---|---|---|---|

| 1 | leesa | $6.83 | $37.93 |

| 2 | purple | $3.13 | $23.50 |

| 3 | ghostbed | $5.97 | $20.00 |

| 4 | best mattress | $4.90 | $16.89 |

| 5 | organic mattress | $4.36 | $16.85 |

| 6 | natural mattress | $3.92 | $16.60 |

| 7 | casper | $3.74 | $15.65 |

| 8 | dreamcloud | $3.77 | $15.00 |

| 9 | select comfort | $5.67 | $15.00 |

| 10 | avocado | $7.87 | $14.37 |

| 11 | winkbed | $3.37 | $14.30 |

| 12 | mattress | $3.55 | $14.13 |

| 13 | hybrid mattress | $3.61 | $13.60 |

| 14 | saatva | $4.88 | $13.00 |

| 15 | latex mattress | $5.79 | $12.00 |

| 16 | tempurpedic | $2.41 | $11.53 |

| 17 | sleep number | $4.92 | $11.10 |

| 18 | memory foam mattress | $2.80 | $11.08 |

| 19 | helix | $1.77 | $10.03 |

| 20 | brooklyn bedding | $3.00 | $9.98 |

| 21 | sealy | $1.53 | $9.30 |

| 22 | coil mattress | $2.25 | $8.84 |

| 23 | serta | $2.81 | $8.00 |

| 24 | simmons | $0.93 | $7.59 |

| 25 | nectar | $3.87 | $6.72 |

| 26 | spring mattress | $1.92 | $6.62 |

| 27 | innerspring mattress | $1.75 | $6.60 |

| 28 | brentwood home | $2.55 | $5.38 |

| 29 | kingsdown | $1.06 | $5.22 |

| 30 | layla | $0.40 | $2.82 |

| 31 | ashley furniture | $0.39 | $1.66 |

Sources: Google

Final Thoughts

Mattress brand recognition is an important part of growing sales, increasing revenue, and gaining popularity among consumers.

The reality is that people only buy a mattress every 8 years, so seeing a mattress advertisement may not mean a sale today.

But when consumers can recognize a brand, they are more likely to remember the name when it’s time to make a new purchase.

This is the power of brand recognition in the mattress industry.